ANNOUNCEMENT OF BOOK BUILDING COMMENCEMENT IN RESPECT OF INTENTION TO FLOAT ON THE QATAR STOCK EXCHANGE. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR WITHIN THE QATAR FINANCIAL CENTRE, THE UNITED STATES OF AMERICA, THE UNITED KINGDOM, THE EUROPEAN UNION, THE STATE OF KUWAIT, THE SULTANATE OF OMAN, THE KINGDOM OF SAUDI ARABIA, THE UNITED ARAB EMIRATES (INCLUDING THE ABU DHABI GLOBAL MARKET AND THE DUBAI INTERNATIONAL FINANCIAL CENTRE), THE KINGDOM OF BAHRAIN, OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT.

QInvest LLC, acting in its capacity as Listing Advisor and Offering Manager on the potential initial public offering (the “IPO”) of MEEZA QSTP LLC (the “Company”), a leading provider of end-to-end IT services in Qatar, hereby announces the price range for the IPO, as well as the commencement of the book building period for the IPO, in accordance with the details set out below.

During the Book Building Subscription Period (as defined below), only Qualified Investors (as defined below) can review the details related to the IPO in the Company’s Offering Prospectus (the “Offering Prospectus”), which will be made available to the Qualified Investors upon commencement of the book building process. The purpose of the book building mechanism is to quantify Qualified Investors demand based on the Price Range, in order to set the final Offer Share price for the Offering.

This announcement relates specifically to the Book Building Subscription Period for Qualified Investors in accordance with the QFMA book building mechanism. The Offering Manager and Listing Adviser and the Company will issue separate announcements for the intention to float in relation to the Offering for individual and corporate public investors in due course.

1. Offering details:

2. Book building process:

3. Book building subscription instructions:

Qualified Investors may subscribe for the Offer Shares as follows:

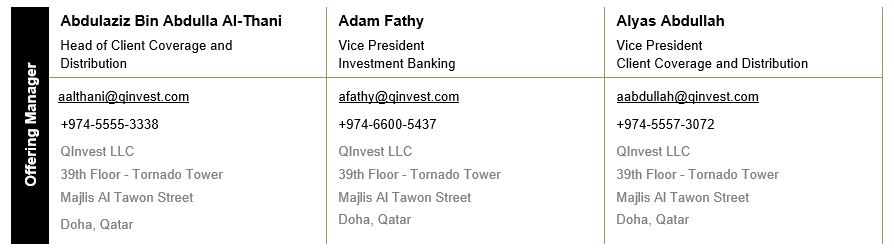

4. Contact details:

Notes

This announcement and its terms are subject to and shall be governed by the laws of the State of Qatar. Any dispute that may arise thereunder shall be settled first through conciliatory negotiations. Only if an amicable settlement of the dispute is not reached by the parties, may they resort to arbitration according to the rules and regulations of the State of Qatar. The place or seat of arbitration shall be in Doha, Qatar and the language of the arbitration proceedings shall be Arabic The Arabic language is the official language of this announcement, and in the event of any contradiction between the Arabic and the English versions, the Arabic version will prevail.

Disclaimer

This announcement is being distributed subject to the provisions of the Instructions for Securities Offering Through Book Building Mechanism and the Offering an Listing of Securities on the Financial Markets Rulebook issued by the QFMA (the “QFMA Rules”), and should not result in any binding undertakings to acquire shares or subscribe in the Offering. This announcement is for information purposes only and under no circumstances shall constitute an offer or invitation, or form the basis for a decision, to invest in any securities of the Company. Neither this announcement nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Qualified Investors should consult the Offering Prospectus before investing in the Shares. The approval of the QFMA on the Offering Prospectus shall not be considered an approval of financial and economic viability of the Company or of the related evaluation outcomes. Members of the Company’s board of directors and the Offering Manager share a joint responsibility toward the correctness of the data included in the Prospectus. The Offering legal advisor is responsible of the correctness of legal approvals and procedures followed by the Company in the process of offering the Shares.

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed by any person for any purpose on the information contained in this announcement or its accuracy, fairness or completeness. The information in this announcement is subject to change. Neither the Company nor the Listing Advisor and Offering Manager or their respective affiliates undertake to provide the recipient of this announcement with any additional information, or to update this announcement or to correct any inaccuracies, and the distribution of this announcement shall not be deemed to be any form of commitment on the part of the Company or the Listing Advisor and Offering Manager to proceed with the Offering or any transaction or arrangement referred to therein.

The contents of this announcement are not to be construed as legal, financial or tax advice.

The distribution of this announcement may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

This announcement is not an offer for the sale of securities of the Company, directly or indirectly, in or into the United States. The Offer Shares may not be offered or sold in the United States unless registered under the US Securities Act of 1933, as amended (the “Securities Act”), or offered in a transaction exempt from, or not subject to, the registration requirements of the Securities Act. The Company has not registered and does not intend to register any portion of the Shares under the Securities Act or the laws of any state in the United States or to conduct a public offering of any securities in the United States. Copies of this announcement are not being, and may not be, distributed, forwarded or otherwise sent, directly or indirectly, in or into the United States.

This announcement does not contain or constitute an offer of, or the solicitation of an offer to buy, the Shares to any person in the United States, European Economic Area, Australia, Canada, South Africa or Japan or in any jurisdiction to whom or in which such offer or solicitation is unlawful. The offer and sale of the Shares have not been and will not be registered under the applicable securities laws of the European Economic Area, Australia, Canada, South Africa or Japan. Subject to certain exceptions, the Shares may not be offered or sold in the European Economic Area, Australia, Canada, South Africa or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada, South Africa or Japan. There will be no public offer of the Shares in the United States, Australia, Canada, South Africa or Japan.

Qualified Investors may only subscribe to the Shares on the basis of the QFMA approved Arabic language Offering Prospectus (and any supplementary prospectus in relation thereto) (the “Offering Prospectus”). The information in this announcement is subject to change. In accordance with the QFMA Rules, copies of the Offering Prospectus will, following publication, be available on the websites of the Company, the Offering Manager, and the QSE.

This announcement is not an offer document for the purposes of the QFMA Rules and should not be construed as such. The QFMA and the QSE do not take any responsibility for the contents of this announcement, do not make any representations as to its accuracy or completeness, and expressly disclaim any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this announcement.

This announcement may include statements that are, or may be deemed to be, “forward-looking statements”. Any forward-looking statements reflect the Company’s current view with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to the Company’s business, results of operations, financial position, liquidity, prospects, growth or strategies. Many factors could cause the actual results to differ materially from those expressed or implied by any such forward-looking statements, including, among other things, risks specifically related to the Company and its operations, the development of global economic and industry conditions, and the impact of economic, political and social developments in the State of Qatar. Forward-looking statements speak only as of the date they are made and the Company does not assume any obligations to update any forward-looking statements.

There is no guarantee that the Offering will occur and you should not base your financial decisions on the Company’s intentions in relation to the Offering at this stage. Acquiring Shares to which this announcement relates may expose an investor to a significant risk of losing the entire amount invested.

Persons considering an investment should consult an investment advisor or an authorized person specializing in advising on such investments.

The Offering Manager is acting exclusively for the Company and no one else in connection with the Offering. They will not regard any other person as their respective clients in relation to the Offering and will not be responsible to anyone other than the Company for providing the protections afforded to their respective clients, arrangement or other matter referred to herein.

The contents of this announcement have been prepared by and are the sole responsibility of the Company. Neither the Offering Manager nor any of their affiliates or respective directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for or makes any representation or warranty, express or implied, as to the truth, accuracy or completeness of the information in this announcement (or whether any information has been omitted from the announcement) or any other information relating to the Company, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.

End announcement.

Copyright © 2024 MEEZA, All Rights Reserved.